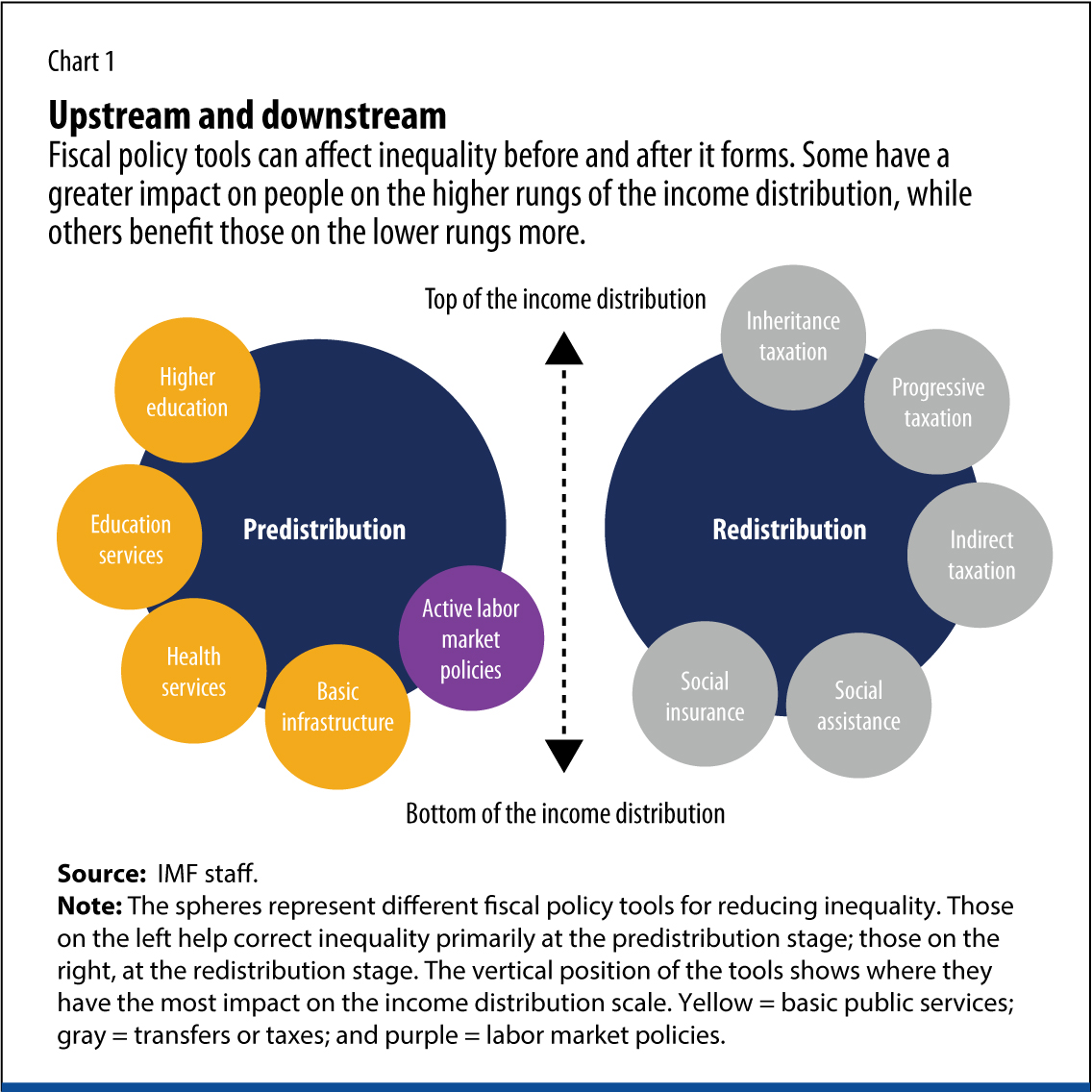

Fiscal Policy and Income Inequality," by David Lipton, First Deputy Managing Director, IMF, Washington, D.C., March 13, 2014

3. How does inequality shape the demand for redistribution? | Does Inequality Matter? : How People Perceive Economic Disparities and Social Mobility | OECD iLibrary

Fiscal Policy and Income Inequality," by David Lipton, First Deputy Managing Director, IMF, Washington, D.C., March 13, 2014

Redistribution, work incentives and thirty years of UK tax and benefit reform | Institute for Fiscal Studies

3. How does inequality shape the demand for redistribution? | Does Inequality Matter? : How People Perceive Economic Disparities and Social Mobility | OECD iLibrary

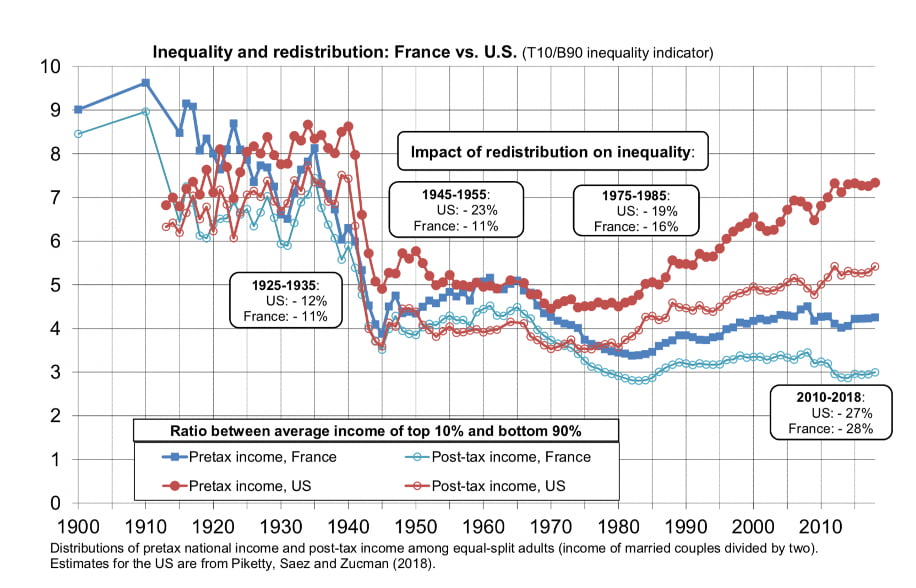

![Revisiting the Debate on Inequality and Economic Development [1] | Cairn.info Revisiting the Debate on Inequality and Economic Development [1] | Cairn.info](https://www.cairn.info/vign_rev/REDP/REDP_255.jpg)